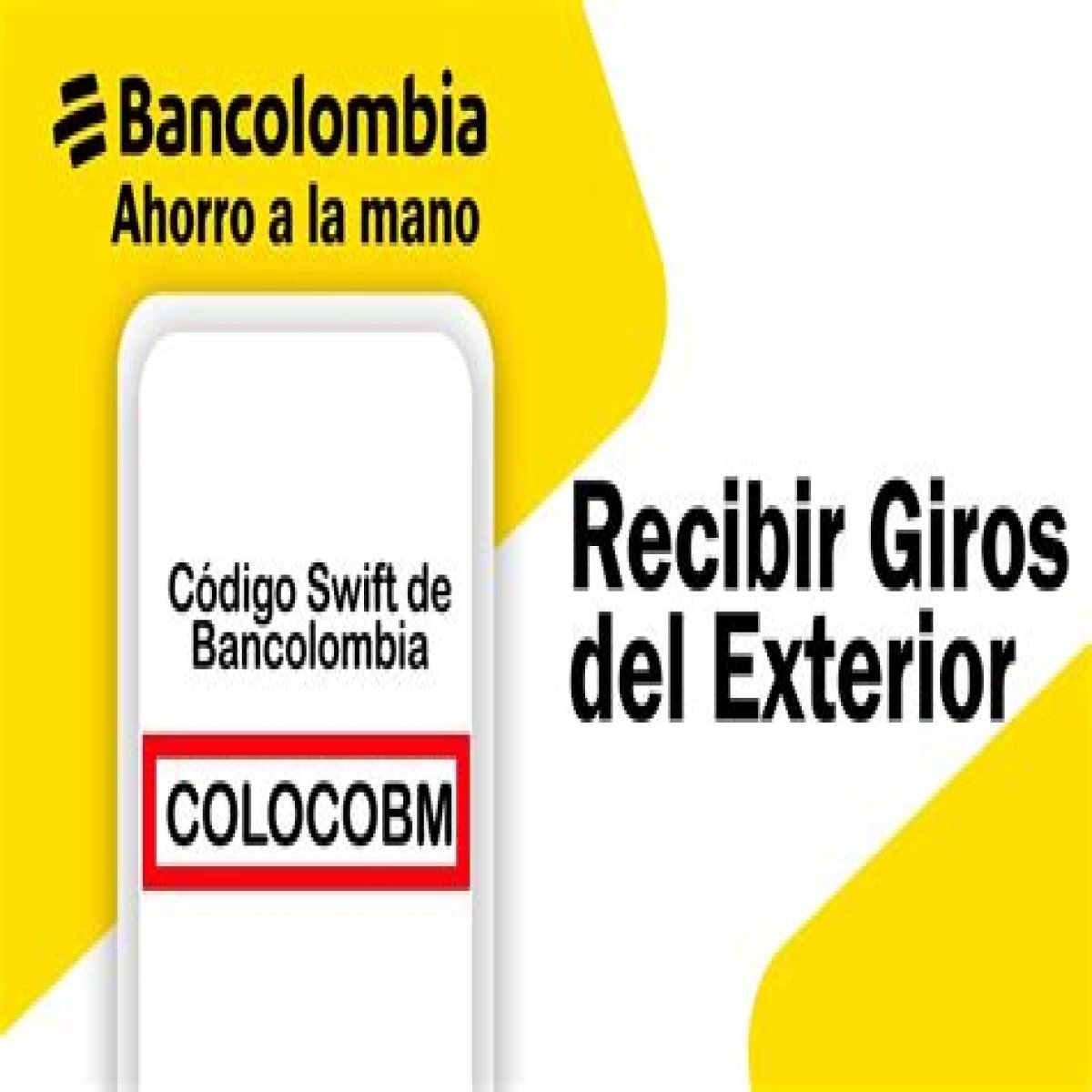

A SWIFT code, also known as a Bank Identifier Code (BIC), is a unique identification code for financial institutions worldwide. It facilitates the secure transfer of money between banks, particularly for international transactions. Bancolombia, one of the largest banks in Colombia, has its own SWIFT code to identify its branches and enable efficient money transfers. The SWIFT code for Bancolombia is COLOCOBMXXX.

SWIFT codes play a crucial role in international banking, ensuring the accuracy and efficiency of cross-border payments. They help banks identify the recipient institution and facilitate seamless transactions. Bancolombia's SWIFT code allows customers to send and receive international payments securely and conveniently.

Understanding SWIFT codes is essential for businesses and individuals who engage in international financial transactions. By providing a unique identifier for each bank, SWIFT codes help streamline the process, reduce errors, and enhance the overall security of cross-border payments.

SWIFT Code Bancolombia

SWIFT codes are essential for international money transfers, and Bancolombia's SWIFT code (COLOCOBMXXX) is unique to its branches. Here are ten key aspects to consider:

- Unique Identification: Each bank has a distinct SWIFT code.

- International Transfers: SWIFT codes facilitate cross-border payments.

- Security: SWIFT codes enhance the security of international transactions.

- Accuracy: SWIFT codes ensure accurate routing of funds to the correct bank.

- Efficiency: SWIFT codes streamline the process of international money transfers.

- Global Reach: SWIFT codes are recognized worldwide, enabling global connectivity.

- Standardized Format: SWIFT codes follow a standardized format (8 or 11 characters) for easy recognition.

- ISO Compliance: SWIFT codes adhere to ISO standards, ensuring international compatibility.

- Regulation: SWIFT codes are regulated by the Society for Worldwide Interbank Financial Telecommunication (SWIFT).

- Customer Convenience: SWIFT codes simplify international payments for businesses and individuals.

In summary, understanding the key aspects of SWIFT codes, including Bancolombia's unique code (COLOCOBMXXX), is crucial for efficient and secure international money transfers. SWIFT codes provide a standardized and reliable method for banks to identify each other, ensuring the smooth flow of funds across borders.

Unique Identification

The unique identification provided by SWIFT codes is a cornerstone of the SWIFT system, including the SWIFT code for Bancolombia (COLOCOBMXXX). This distinctiveness is crucial for several reasons:

- Accurate Routing: Distinct SWIFT codes ensure that international money transfers are accurately routed to the intended recipient bank. Each bank's unique code eliminates confusion and reduces the risk of errors.

- Security: The uniqueness of SWIFT codes enhances security by preventing fraudulent transactions. By identifying the specific bank involved, it becomes more challenging for unauthorized parties to intercept or redirect funds.

- Global Connectivity: The distinct SWIFT codes of banks worldwide facilitate seamless cross-border payments. This connectivity is essential for businesses and individuals who engage in international trade or personal remittances.

For example, Bancolombia's SWIFT code (COLOCOBMXXX) is unique to its branches, allowing for accurate and secure transfer of funds to and from other banks around the world. This distinct identification is vital for the efficient functioning of international finance.

Understanding the importance of unique SWIFT codes is crucial for businesses and individuals involved in global financial transactions. It ensures the accuracy, security, and efficiency of cross-border payments, fostering international trade and economic growth.

International Transfers

SWIFT codes play a critical role in facilitating international transfers, including those involving Bancolombia. Here are several key facets to explore:

- Accuracy and Efficiency: SWIFT codes ensure accurate and efficient routing of cross-border payments. Each bank has a unique SWIFT code, reducing errors and delays in international money transfers.

- Global Connectivity: SWIFT codes enable seamless global connectivity for financial institutions. Bancolombia's SWIFT code (COLOCOBMXXX) allows for secure and efficient transfers to and from banks worldwide.

- Reduced Costs: SWIFT codes contribute to reduced costs in international transfers. By streamlining the process and eliminating intermediaries, SWIFT helps lower transaction fees for businesses and individuals.

- Security and Compliance: SWIFT codes enhance the security of international transfers. They adhere to strict international standards, ensuring compliance with regulations and reducing the risk of fraud.

These facets underscore the importance of SWIFT codes in facilitating international transfers. Bancolombia's SWIFT code (COLOCOBMXXX) plays a vital role in enabling secure, efficient, and cost-effective cross-border payments, supporting global trade and economic growth.

Security

SWIFT codes play a vital role in enhancing the security of international transactions, safeguarding the transfer of funds between banks, including Bancolombia. Here's how SWIFT codes contribute to secure international payments:

- Unique Identification: Each bank has a unique SWIFT code, ensuring accurate routing and preventing fraudulent transactions. Bancolombia's SWIFT code (COLOCOBMXXX) is exclusive to its branches, minimizing the risk of misdirected or intercepted funds.

- Authentication and Verification: SWIFT codes facilitate secure authentication and verification processes between banks. They help validate the legitimacy of transactions, reducing the risk of unauthorized access and theft.

- Compliance and Regulation: SWIFT codes adhere to strict international standards and regulations, promoting transparency and compliance in cross-border payments. Bancolombia's SWIFT code aligns with these standards, ensuring adherence to best practices and minimizing the risk of financial crime.

In summary, SWIFT codes are essential for enhancing the security of international transactions. Bancolombia's SWIFT code (COLOCOBMXXX) plays a crucial role in safeguarding the transfer of funds, preventing fraud, and ensuring compliance with international standards. Understanding the security features of SWIFT codes is vital for businesses and individuals involved in global financial transactions.

Accuracy

The accuracy of SWIFT codes is paramount in ensuring that international funds are routed to the correct bank, including Bancolombia. This accuracy is critical for several reasons:

- Precise Delivery: SWIFT codes guarantee that funds are transferred to the intended recipient bank, eliminating errors and delays caused by incorrect routing information.

- Fraud Prevention: Accurate SWIFT codes help prevent fraud by ensuring that funds are not misdirected to unauthorized accounts.

- Compliance: Adhering to accurate SWIFT codes is essential for banks to comply with international regulations and standards, reducing the risk of penalties and reputational damage.

For example, when initiating an international transfer to Bancolombia, utilizing the correct SWIFT code (COLOCOBMXXX) ensures that the funds are accurately routed to the intended branch. This precision is crucial for businesses and individuals to avoid financial losses, delays, and potential legal complications.

Understanding the importance of SWIFT code accuracy is vital for all parties involved in international money transfers. Accurate SWIFT codes facilitate seamless, secure, and timely cross-border payments, supporting global trade and economic growth.

Efficiency

SWIFT codes, including the SWIFT code for Bancolombia (COLOCOBMXXX), play a crucial role in streamlining the process of international money transfers, offering several key benefits:

- Reduced Timelines: SWIFT codes facilitate faster processing of international transfers, reducing the time taken for funds to reach the intended recipient.

- Simplified Documentation: SWIFT codes eliminate the need for extensive paperwork and manual processes, simplifying the documentation requirements for international money transfers.

- Cost Optimization: SWIFT codes help optimize costs associated with international transfers by reducing intermediary fees and exchange rate fluctuations.

- Increased Transparency: SWIFT codes provide greater transparency in international money transfers, allowing businesses and individuals to track the status of their transactions.

For instance, using Bancolombia's SWIFT code (COLOCOBMXXX) for international transfers streamlines the process, reducing delays, minimizing paperwork, and optimizing costs. This efficiency is crucial for businesses engaged in global trade and individuals sending remittances abroad.

Overall, SWIFT codes, including the SWIFT code for Bancolombia, enhance the efficiency of international money transfers, promoting global commerce and financial inclusion.

Global Reach

The global reach of SWIFT codes, exemplified by the unique SWIFT code for Bancolombia (COLOCOBMXXX), plays a pivotal role in facilitating seamless international money transfers. This global connectivity offers numerous advantages:

- Cross-Border Transactions: SWIFT codes bridge geographic distances, enabling efficient and secure money transfers between countries and continents.

- Simplified International Business: Businesses can engage in global trade with ease, knowing that SWIFT codes streamline international payments.

- Enhanced Global Investment: SWIFT codes facilitate cross-border investments, promoting economic growth and financial integration.

- Support for Remittances: Individuals can send remittances to family and friends abroad quickly and reliably using SWIFT codes.

In conclusion, the global reach of SWIFT codes, including the SWIFT code for Bancolombia, is a cornerstone of modern international finance. It fosters global connectivity, simplifies cross-border transactions, and supports economic growth and development worldwide.

Standardized Format

The standardized format of SWIFT codes, including the SWIFT code for Bancolombia (COLOCOBMXXX), plays a critical role in the smooth functioning of international money transfers. This standardized format, consisting of 8 or 11 characters, offers several key benefits:

- Simplified Identification: The standardized format makes SWIFT codes easy to identify and recognize, facilitating accurate and efficient processing of international payments.

- Reduced Errors: The consistent format minimizes the risk of errors during manual data entry, ensuring the accuracy and reliability of international money transfers.

- Global Acceptance: The standardized format ensures universal acceptance of SWIFT codes by banks and financial institutions worldwide, promoting seamless cross-border transactions.

For instance, the SWIFT code for Bancolombia (COLOCOBMXXX) adheres to the standardized format, enabling easy recognition and simplifying international money transfers to and from Bancolombia branches. This standardized format is essential for the efficient and secure movement of funds across borders.

Understanding the importance of the standardized format of SWIFT codes is crucial for businesses and individuals engaged in international financial transactions. It facilitates accurate, efficient, and reliable cross-border payments, supporting global trade and economic growth.

ISO Compliance

ISO compliance plays a vital role in the context of "swift code bancolombia" by ensuring that SWIFT codes adhere to international standards established by the International Organization for Standardization (ISO). This compliance offers several important benefits:

- Universal Acceptance: Compliance with ISO standards guarantees that SWIFT codes are universally accepted and recognized by banks and financial institutions worldwide. This facilitates seamless cross-border transactions and eliminates the need for intermediaries or manual conversions.

- Accuracy and Reliability: ISO standards define specific formats and validation rules for SWIFT codes, ensuring their accuracy and reliability. This helps prevent errors and delays in international money transfers, fostering trust and confidence in the global financial system.

- Interoperability: ISO compliance enables different financial networks and systems to communicate effectively using SWIFT codes. This interoperability promotes innovation and competition within the financial industry, ultimately benefiting businesses and consumers.

In summary, ISO compliance is fundamental to the effective functioning of "swift code bancolombia" and the broader SWIFT network. It ensures international compatibility, accuracy, reliability, and interoperability, facilitating the efficient and secure movement of funds across borders.

Regulation

The regulation of SWIFT codes by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a crucial aspect of the "swift code bancolombia" system. SWIFT's role as a regulatory body ensures the secure and efficient functioning of international money transfers, including those involving Bancolombia.

SWIFT's regulations establish standards and guidelines for the use of SWIFT codes, ensuring their accuracy, reliability, and universal acceptance. These regulations mandate specific formats, validation rules, and security measures to minimize errors, fraud, and unauthorized access. By adhering to SWIFT's regulations, Bancolombia and other financial institutions contribute to the stability and integrity of the global financial system.

Moreover, SWIFT's regulatory oversight fosters trust and confidence among banks and financial institutions. The standardized and regulated nature of SWIFT codes reduces the risk of miscommunication or misunderstandings, facilitating seamless cross-border transactions. This regulation also promotes fair competition and innovation within the financial industry, ultimately benefiting businesses and consumers.

In summary, the regulation of SWIFT codes by SWIFT is paramount to the effectiveness and security of "swift code bancolombia" and the broader SWIFT network. It ensures the accuracy, reliability, and universal acceptance of SWIFT codes, fostering a secure and efficient environment for international money transfers.

Customer Convenience

SWIFT codes, including the unique identifier for Bancolombia (COLOCOBMXXX), play a pivotal role in simplifying international payments for businesses and individuals, enhancing convenience and accessibility in global financial transactions.

- Seamless Cross-Border Transfers: SWIFT codes enable businesses and individuals to send and receive funds across borders seamlessly, eliminating the complexities and delays associated with traditional methods.

- Reduced Costs and Time: SWIFT codes streamline international payments, reducing transaction fees and processing times compared to alternative channels, making cross-border payments more cost-effective and efficient.

- Enhanced Transparency and Tracking: SWIFT codes provide greater transparency and allow businesses and individuals to track the status of their international payments, ensuring peace of mind and reducing uncertainties.

- Increased Accessibility: SWIFT codes facilitate international payments from various platforms, including online banking and mobile applications, making it easier for businesses and individuals to conduct global transactions.

In summary, SWIFT codes, such as the one used by Bancolombia (COLOCOBMXXX), greatly enhance customer convenience in international payments. They simplify the process, reduce costs and time, provide greater transparency, and increase accessibility, promoting financial inclusion and economic growth globally.

FAQs on "swift code bancolombia"

This section addresses frequently asked questions concerning "swift code bancolombia" to provide clarity and enhance understanding.

Question 1: What is a SWIFT code and how does it relate to Bancolombia?A SWIFT code is a unique identifier assigned to financial institutions worldwide, facilitating secure and efficient international money transfers. Bancolombia's SWIFT code (COLOCOBMXXX) is used to identify its branches for cross-border transactions.

Question 2: Why is using the correct SWIFT code crucial for international payments?Utilizing the correct SWIFT code ensures accurate routing of funds to the intended recipient bank. Incorrect SWIFT codes can lead to delays, errors, or even failed transactions.

Question 3: How can I find the SWIFT code for Bancolombia?The SWIFT code for Bancolombia is COLOCOBMXXX. It can be found on bank statements, official bank websites, or by contacting Bancolombia directly.

Question 4: Are SWIFT codes regulated?Yes, SWIFT codes are regulated by the Society for Worldwide Interbank Financial Telecommunication (SWIFT). This regulation ensures the accuracy, reliability, and universal acceptance of SWIFT codes.

Question 5: Can I use a SWIFT code to track my international transfer?While SWIFT codes are used to facilitate international transfers, they are not typically used for tracking the status of individual transactions. Banks or money transfer providers usually provide separate tracking mechanisms for this purpose.

Understanding these FAQs can help businesses and individuals navigate international money transfers involving Bancolombia seamlessly and efficiently.

For further information or assistance, please consult your bank or financial advisor.

Tips on Using "swift code bancolombia"

When conducting international money transfers involving Bancolombia, utilizing the correct SWIFT code is crucial. Here are some essential tips to ensure smooth and successful transactions:

Verify the SWIFT Code: Double-check the accuracy of the SWIFT code (COLOCOBMXXX) before initiating a transfer. Confirm the code through official bank statements, the Bancolombia website, or by contacting the bank directly.

Provide Clear Instructions: Ensure that your payment instructions clearly state the beneficiary's name, account number, and the intended amount. This information should align with the details linked to the SWIFT code.

Check Transfer Fees and Timelines: Inquire about any applicable transfer fees and estimated processing times with your bank or money transfer provider. This will help you plan accordingly and avoid unexpected expenses or delays.

Use Secure Channels: Initiate international transfers through secure and trusted platforms, such as online banking or reputable money transfer services. Avoid sharing sensitive financial information over unsecure channels.

Monitor Your Transfer: Keep track of your transfer status using the tracking mechanisms provided by your bank or money transfer provider. Promptly report any irregularities or delays to your financial institution.

By following these tips, you can enhance the efficiency and security of your international money transfers involving "swift code bancolombia," ensuring timely delivery of funds to the intended recipient.

Remember, accurate and responsible use of SWIFT codes is essential for seamless cross-border transactions. If you encounter any challenges or have additional questions, do not hesitate to consult your bank or a qualified financial advisor for guidance.

Conclusion

SWIFT codes, including the unique identifier for Bancolombia (COLOCOBMXXX), play a critical role in facilitating secure and efficient international money transfers. Understanding and correctly utilizing SWIFT codes is essential for businesses and individuals engaging in global financial transactions.

This article has explored various aspects of "swift code bancolombia," emphasizing its importance, benefits, and implications. The standardized format, ISO compliance, and regulation by SWIFT ensure the accuracy, reliability, and universal acceptance of SWIFT codes. Moreover, their use simplifies international payments, reduces costs and time, and enhances transparency and tracking capabilities.

By adhering to the tips outlined in this article, businesses and individuals can optimize their use of "swift code bancolombia" and ensure smooth and successful cross-border transactions. Accurate and responsible use of SWIFT codes is crucial for the seamless flow of funds across borders, supporting global economic growth and financial inclusion.